1 super easy way to supercharge your online writing earnings now

I had a lousy earnings day recently from my writing.

I couldn’t tell you why.

I don’t understand or control the algorithms.

Perhaps there weren’t many people online this particular Sunday.

Or maybe I wasn’t producing my best work last week (I thought it was fine).

Whatever the reason, I was a bit annoyed when I saw how much I made.

But then I opened another app and realized that I’d actually made 19.84% more OVERALL than the day before.

It was not only an important reminder that I should stay focused on my process instead of having a pity party about one aspect of my business on one day.

It also provided a great example of one easy way you can supercharge your online earnings by doing relatively little work.

Allow me to explain.

Diversify, diversify, diversify

Earlier this week, I wrote a piece on why I believe you should never rely solely on one business or publishing platform.

Not only are you betting said platform will always be there and will always pay you a fair wage (thus risking going broke one day), you’re limiting how much you can make as an entrepreneur.

My point was, you should always be diversifying.

For me as a content creator, that means using this platform as a foundation, but also branching out and developing side businesses like my YouTube channel and Substack email newsletter.

But I also take this one step further.

You see, writing online, making YouTube videos, or any business for that matter — they’re anything but passive.

As much as get-rich-quick snake oil salesmen want you to believe you can easily make money online with no effort, they take a ton of time and effort.

But that doesn’t mean you can’t supplement your efforts with some passive income.

And it’s how I made more yesterday than the day before despite my writing earnings taking a dip.

Instead of wasting my extra earnings on stupid stuff like eating out every night, buying more clothes than I need, or piling up expensive electronics, almost every penny I earn goes into income-generating investments.

There are so many benefits to doing this:

You are creating new revenue streams by putting your money to work for you

You are smoothing out your variance as a content creator — you might make less one day, but your investments could theoretically make up the difference like they did for me yesterday

You can be super tax efficient — meaning your money stays yours (at least for now)

My little employees

If you’ve been following me for any amount of time, you know I like to refer to my digital assets — stories, YouTube videos, etc. — as my little employees.

Every morning, they go out into the world and come home at night with a bit of cash.

I have lots of those lil’ fellas working for me now — close to 350 articles and more than 50 videos.

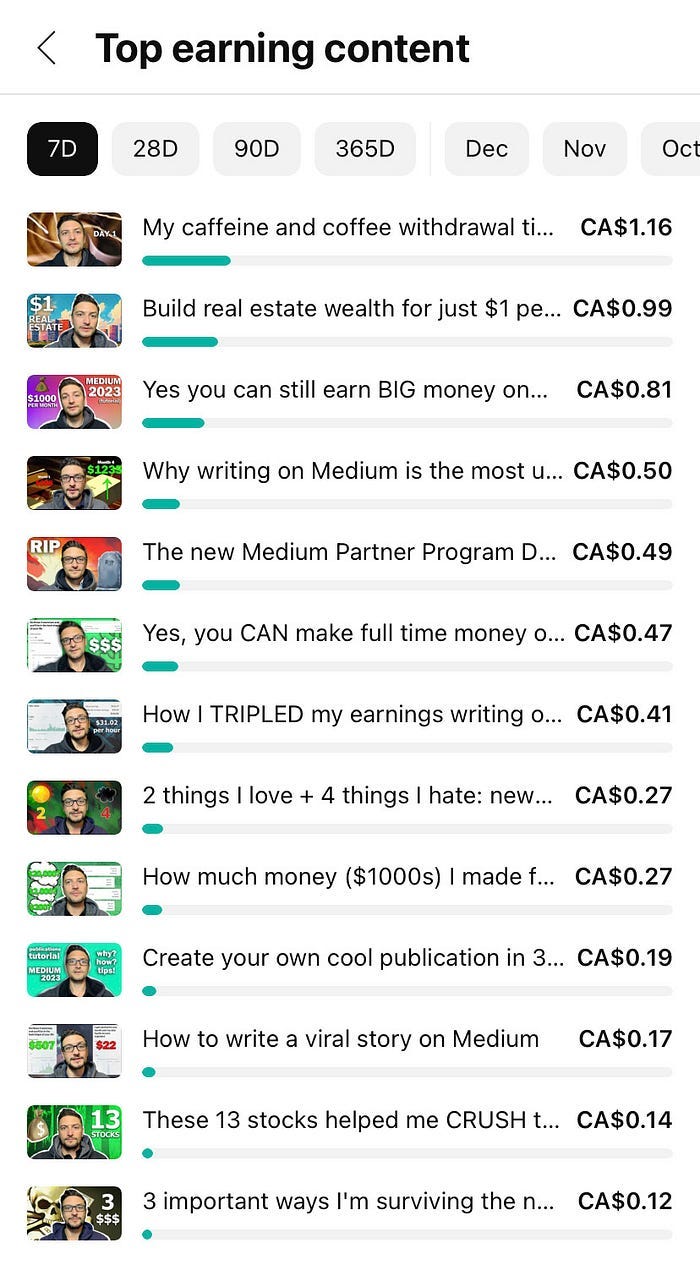

For example, here’s what my YouTube employees earned this week:

Not a lot, to be sure, but every little bit counts.

The more employees I can “hire” over a wide range of businesses, the more I can make in the long run.

That’s where my portfolio comes in.

Almost every penny I earn gets invested because, in order to reach my goal of leaving commuter life behind, I need to turn my money into more money.

I must always be compounding.

So what does this look like in practice?

Well, I invest in a lot of different areas:

Tech stocks of companies I use every day

Dividend-paying value stocks

Residential real estate investment trusts (REITs)

Equity Exchange-traded Funds (ETFs)

Bond and US Treasury ETFs

Let’s talk about the latter for a sec.

Typically I don’t buy fixed income investments because the yields are so small, but since an historic crash in treasuries and bonds, I’ve been snapping them up.

A lot of them now pay 4–5% in actual passive income.

So what I didn’t earn from writing yesterday was more than made up for with a dividend payment from my treasury ETF.

Some of this may sound like gobbledygook if you aren’t into investing, but the overall point is that you’re not going to get as far as you want to go without many different revenue streams.

And the more you can add that are truly passive, the better.

I’m not making a ton from my investments yet either, but every day I have a bit more money trickling in.

It won’t make that much difference over days and weeks, but over years, this becomes truly life-changing.

As with my content earnings, making real significant cash from investments comes from years of sustained efforts, not one-off get-rich-quick-schemes.

Never stop compounding

So in conclusion, when I say you should have a lot of irons in the fire, that extends to using your content money to make even more money.

The benefit is that, once you buy a solid investment, you don’t really need to do much other than monitor it occasionally and cash cheques.

And (bonus!) you can usually do it in a tax-efficient way so that your earnings actually stay YOUR earnings.

Publish Every Day project update: Day 58

I’m trying to see if I can make enough money to retire from commuter life within a year by publishing every day on different platforms and investing my earnings into passive income vehicles.

How much I need to retire: $250 CAD per day

What I earned on Day 58: $35.84 (writing) + $1.33 (YouTube) + $14.18 dividend income = $51.35 total

What I published yesterday:

This post about 1 extra thing you must do to make real money writing online

This article in my email newsletter:

My top 5 trending stories:

One reason you’ll succeed (or fail) making big money writing online

1 fitness trap Ryan Reynolds overcomes to stay super fit at 47

One NEW reason I’m hyper-motivated to change my life writing online now

The real truth of making big money writing online (they’re lying)

1 important thing to NEVER forget in your online writing cash quest

Disclaimer: Numbers in this post were accurate at time of writing and will not be accurate at time of reading. The author of this article is not a financial advisor. This commentary is provided for general informational and entertainment purposes only and should not be construed as financial, investment, tax, legal or accounting advice. It does not constitute an offer or solicitation to buy or sell any securities referred to. Consult your financial advisor prior to making financial decisions.

With all content platforms, there is the danger they will cease to exist or change the rules. I like Substack for the way they allow the writers to download the email list of their subscribers.